Partnership Overview: Types, Laws, and Agreements

What is the Meaning of Partnership Agreements?

Partnership agreements are contracts between two or more parties to do a joint business venture for earning profits and managing liabilities. For this, parties sign partnership agreements containing the terms and conditions of administrating partnership business.

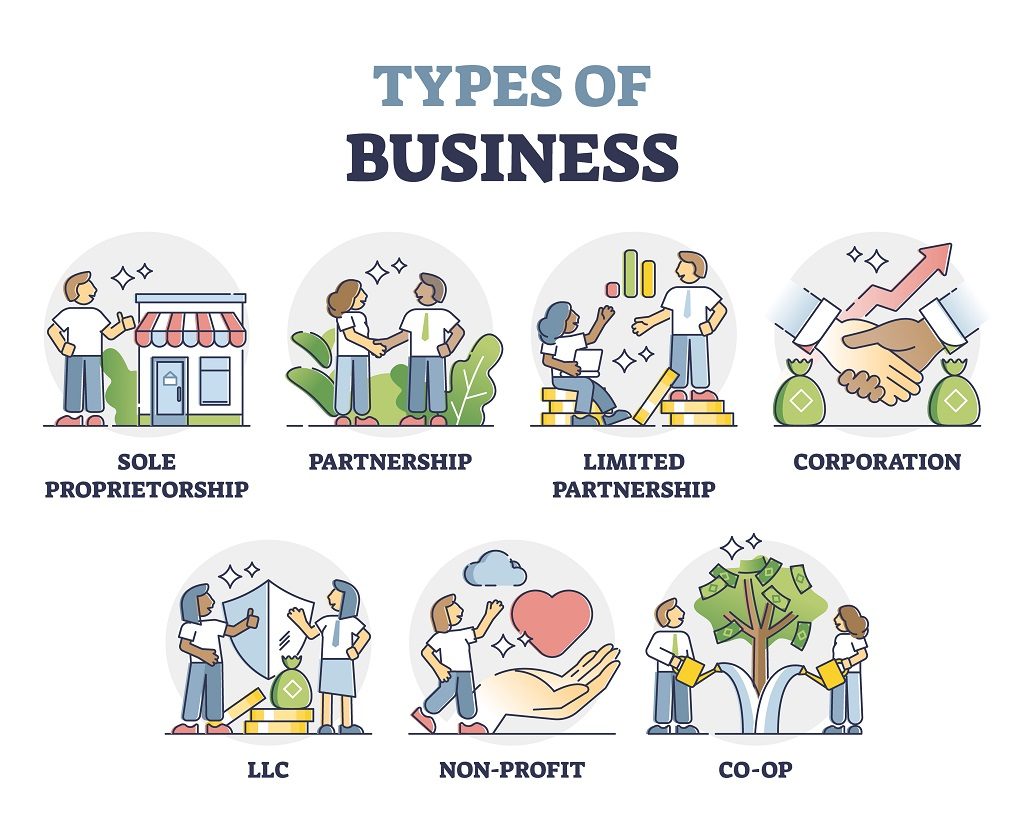

The partnership agreements may be between individuals, corporations, governments, non-profit organizations, etc. These entities come into an accord that changes the rights and liabilities of the parties. Thereby in some partnerships, all the partners are equally liable and in some their liability is limited. This article explores the types, laws, and partnership agreements.

What are The Elements of Partnership?

Broadly partnership is divided into General Partnership, Limited Partnership, and Limited Liability Partnership. The goal of the partnership varies with the type of agreement. Intra-state partnership agreements are governed by local laws. Whereas, international treaties administer the inter-state accords of business partnership. However, all the types have some elements in common. Such as:

1. Partnership Agreements

All the parties who have the intention to join hands need to draft an agreement. This accord encompasses all the necessary details of the parties, terms and conditions, objectives, and purposes of the partnership. An oral agreement is also valid but to avoid any dispute in the future written business document of the contract is necessary.

2. Intention of the Parties

The free intention of the parties to come into a partnership is necessary. All the partners must give their consent to the contract.

3. Purpose and Goal

The agreement reveals the purpose of the partnership and why parties want to come closer. Moreover, it also enlists the details of the objectives and goals of the partnership.

4. Liabilities of the Parties

Interestingly it is the agreement that specifies the liability of each partner. It mentions both financial and legal liabilities. As per the type of contract, the liabilities vary.

5. Shared profit

Commonly shared profit means all the partners have a share in the profit. Additionally, in unlimited partnerships, the profits and liabilities are also unlimited. Whereas, in limited partnerships, the contract shows the percentile of profit and liability.

What is The Purpose of Partnership Agreements?

Strictly speaking, the objective of the partnership is to enhance business profits. Also, the partners are liable financially and legally. The magnitude of liability is not equal per se. However, it depends on the sort of agreement.

For instance, company A comes in a general partnership agreement with company B and the goal is to boost the business. Now, if any debt dispute arises with Company A, both partners will be equally liable. Moreover, debt is recoverable from the personal assets of the partners too.

What Are Partnership Agreements Laws?

Every state has different laws for partnership agreements. And some states have constitutional provisions that support international commercial agreements. Yet they do not apply to international trade agreements of all the states.

Hundreds of persons (natural and artificial) perform partnership agreements execution around the globe at the international level. Several international laws oversee such agreements. Importantly, to deal with international partnership agreements transactions, there isn’t a single specified law. The major sources of such agreements are as follows;

1. Customs

In the international arena, customs play a crucial role as a source of law. To govern partnership contracts customary international law is an authentic source. In addition to this customs must have the consensus of the majority

2. International Treaties on Partnership Agreements

Treaties may be between two states or more than two states. To promote international economic and commercial relationships states develop laws between themselves. An agreement between two or more states is a bilateral and multilateral treaty respectively. For instance, Peru-United States Trade Promotion Agreement and The North American Free Trade Agreement (NAFTA) are examples of bilateral and multilateral treaties.

3. United Nations Law

The third tier of international law is organizational law. Undoubtedly, the UN laws are the most familiar and have a separate commission that deals with partnership agreements. Convention on Contracts for the International Sale of Goods (CISG) 1980 applies to the member states of the UN.

Types of Partnership Agreements

As explained earlier, broadly partnership agreements have three categories. Their details are enlisted below.

1. General Partnership Agreements

The parties to this partnership are fully liable for legal and financial liabilities. Each party is equally liable in extent. Thus, parties share profits equally, and losses are also equally divided. The court may order to attach the personal assets of the parties to recover debts. Hence, under this partnership, the parties are personally liable.

2. Limited Liability Partnership Agreements

Under this agreement, the parties have limited liability up to their share. Primarily, one partner is not accountable for the other. Secondly, the partners are not personally liable for each other. And this structure is common in business and law firms or the medical field. For instance, if one doctor is liable for medical malpractice in a partnership agreement the other isn’t liable. Also, in the case of law firms, the debt of one partner is not recoverable from the other.

3. Limited Partnership Agreements

Interestingly it is a combination of both types as mentioned above. One partner is generally liable and the other or at least one is limited responsible. Both in financial and legal matters. The limited partners are the silent partner because they do not participate in management.

Hence, different liabilities arising out of different partnership agreements. Furthermore, it is easy and beneficial to develop partnerships instead of LLCs or corporations because they are tax friendly.